According to the latest data from the Office for National Statistics (ONS), the UK labour market continued to cool gradually in the third quarter. Vacancies fell by 35,000 to 831,000 nationwide, and have fallen continuously from post-pandemic peaks for over two years.

Year-over-year growth in regular pay continues to ease, falling 0.1 percentage points to 4.8% in July to September, though even that slower pace remains uncomfortably high for Bank of England policymakers. That’s one reason why the Bank has signalled that further reductions in interest rates are likely to be gradual, mindful of upside inflation risks should firms pass on higher labour costs by raising prices.

The unemployment rate edged up 0.1 percentage points, to 4.3% in the three months to September, while inactivity dropped over the quarter. However, these estimates come with the usual warning given ongoing issues with the underlying Labour Force Survey, which continues to complicate policymakers’ task of assessing underlying labour market strength.

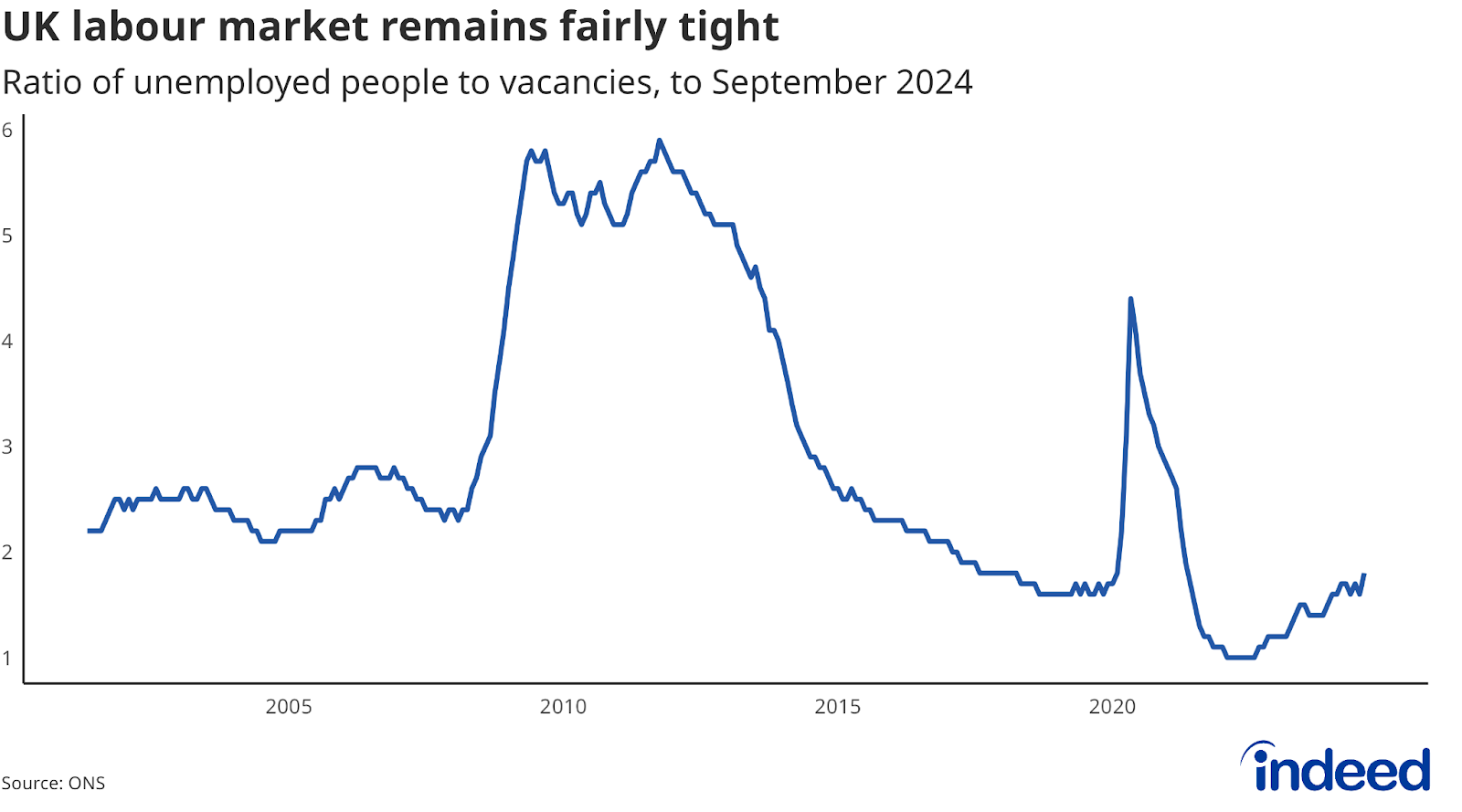

Broadly, the figures show a labour market that continues to gradually loosen but remains somewhat tight, with 1.8 unemployed jobseekers for each vacancy. That’s up from lows of 1.0 in mid-2022 but is similar to immediate pre-pandemic levels, and still relatively low by the standards of the past two decades.

Tackling economic inactivity remains a priority for the government, which wants to boost labour supply as one pillar of raising the UK economy’s growth potential. But the UK labour market faces a handful of near-term headwinds. October’s Budget announcements, which included a hike in employer social security contributions, are expected to weigh on employment. And the government’s workers’ rights agenda is also likely to push employers towards a more cautious approach to hiring.